|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring Mortgage Refinance Options in Houston: A Comprehensive GuideRefinancing your mortgage in Houston can be a strategic move for homeowners looking to improve their financial situation. Whether you aim to lower your interest rate, reduce monthly payments, or access home equity, understanding the refinance process is crucial. Benefits of Mortgage RefinancingLower Interest Rates: One of the primary reasons homeowners consider refinancing is to take advantage of lower interest rates. This can significantly reduce the overall cost of your mortgage. Reduce Monthly Payments: By securing a lower interest rate, you can decrease your monthly payments, freeing up cash for other expenses or investments.

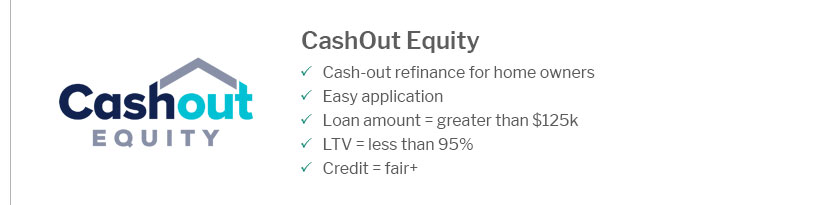

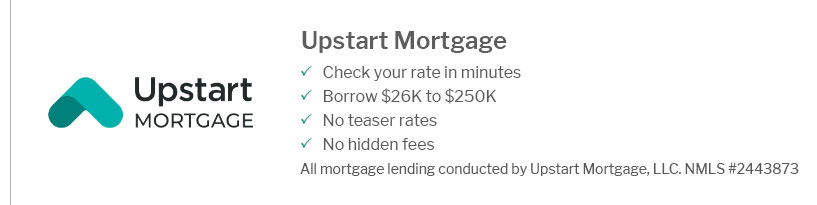

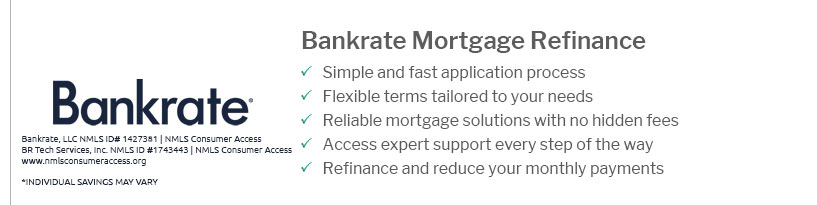

Steps to Refinance Your Mortgage in HoustonEvaluate Your Financial SituationBefore you start, assess your current financial status. Consider your credit score, income stability, and any debts you may have. This evaluation will help you determine if refinancing is the right choice. Shop for the Best RatesIt’s essential to compare rates from various lenders to find the best deal. You can start by checking out fast mortgage pre approval options to streamline the process. Prepare Necessary DocumentationGather all required documents such as pay stubs, tax returns, and bank statements. Having these ready will speed up the refinancing process. Types of Mortgage Refinance OptionsRate-and-Term Refinance: This is the most common type of refinance, where you aim to change the interest rate, the loan term, or both. Cash-Out Refinance: This option allows you to take out a new mortgage for more than you owe and pocket the difference. It's ideal for funding large expenses. Considerations for FHA Loan RefinancingIf you have an FHA loan, you may want to explore options with banks that give FHA loans for specific refinance programs that can offer favorable terms. FAQs About Mortgage Refinancing in Houston

Refinancing your mortgage in Houston can offer substantial benefits. By understanding the process and evaluating your financial situation, you can make an informed decision that aligns with your financial goals. https://lonestarfinancing.com/houston/

Lone Star Financing specializes in residential home loans in Texas and offers personalized solutions, competitive rates, exceptional service, and local Houston ... https://www.nerdwallet.com/mortgages/mortgage-rates/texas/houston

Today's mortgage rates in Houston, TX are 6.838% for a 30-year fixed, 5.936% for a 15-year fixed, and 7.030% for a 5-year adjustable-rate mortgage (ARM). https://www.smartcu.org/personal/mortgage-finance

Looking to buy a new home or refinance your mortgage? We help first-time and experienced home buyers get the home of their dreams. Let our friendly and ...

|

|---|